FREE NEWSLETTER

IF YOU’RE IN YOUR 60s or older and making sizable Roth conversions, it isn’t just income taxes that you need to worry about. You may also trigger much higher Medicare Part B and Part D premiums.

We’re talking here about those Medicare surcharges known as IRMAA, short for income-related monthly adjustment amount. These surcharges are over and above 2023’s standard $1,979 per person Medicare premium, and they’re based on income from two years earlier.

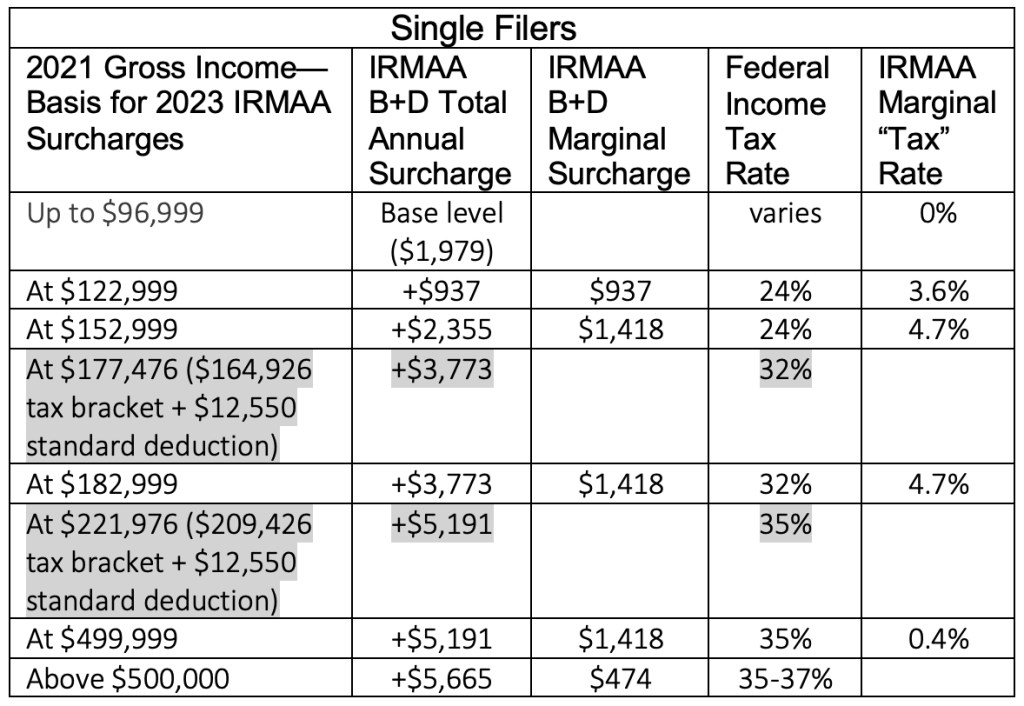

IRMAA’s cost impact is usually discussed in terms of monthly per-person dollar amounts. But to give readers a better handle on the true cost, I’ve converted IRMAA’s 2023 surcharges into something more akin to marginal income-tax rates.

IRMAA surcharges might amount to around 1% or 2% of total income. But that’s the average rate. What I’m focused on here is the marginal rate. As you’ll see in the tables below, I’ve calculated “tax-percentage equivalent” IRMAA costs for both single and married taxpayers. These show that the marginal IRMAA surcharges are a minimum 3% to 5% of the additional income involved—but that assumes you’re near the top of each IRMAA income bracket.

Suppose you’re single and your 2021 modified adjusted gross income (MAGI) placed you at the top of the first 2023 IRMAA bracket, which is $97,000 to $123,000. You’d pay a surcharge of $937 in 2023. That surcharge is equal to 3.6% of the total dollar bracket amount above $97,000. Put another way, this 3.6% rate assumes your income was just shy of $123,000.

What if your income was below the bracket maximums? The marginal surcharge “tax” rate will be even higher than 3% to 5%—and it could be vastly higher. How come? IRMAA is a so-called cliff penalty, meaning the full surcharge for any bracket is levied as soon as your income crosses that bracket’s threshold income. In other words, IRMAA surcharges for each income bracket behave totally unlike regular income taxes, where the same marginal tax rate applies to each dollar within that income-tax bracket.

The tables also highlight two federal income-tax thresholds, which are shaded in grey. For instance, the 2021 income-tax brackets included a sharp jump in marginal tax rate from 24% to 32% for single filers with taxable income of $164,926 and above, and for joint filers at $329,851 and above. In the tables, these income thresholds are adjusted for the standard deduction, so they’re comparable to the IRMAA thresholds. Keeping an eye on such federal income-tax thresholds can be as important as managing your IRMAA brackets.

Considering Roth conversions and worried about IRMAA? Here are seven insights that my wife and I have gleaned:

John Yeigh is an author, speaker, coach, youth sports advocate and businessman with more than 30 years of publishing experience in the sports, finance and scientific fields. His book “Win the Youth Sports Game” was published in 2021. John retired in 2017 from the oil industry, where he negotiated financial details for multi-billion-dollar international projects. Check out his earlier articles.

John Yeigh is an author, speaker, coach, youth sports advocate and businessman with more than 30 years of publishing experience in the sports, finance and scientific fields. His book “Win the Youth Sports Game” was published in 2021. John retired in 2017 from the oil industry, where he negotiated financial details for multi-billion-dollar international projects. Check out his earlier articles.

Want to receive our weekly newsletter? Sign up now. How about our daily alert about the site's latest posts? Join the list.

Is it just me, or does the idea of a Medicare surcharge sound like a first world problem, and specifically for those in an upper income bracket? I also would ask: what’s the alternative? At age 75, the thought of looking and paying for alternative health insurance is not a very appetizing thought.

I would feel blessed if I was a member of the exclusive club of those less than 10% of retirees who qualified to pay these additional costs,

Judge Learned Hand said “anyone may so arrange his affairs that his taxes shall be as low as possible.”

This applies equally to those with more, and those with less.

Mr. Quinn will say that IRMAA is not a tax (as he does in incessantly), but since it does represent funds extracted from us by the government, and can be minimized by arranging one’s affairs properly, then I think Judge Hand’s sentiment is properly applied here.

And since this blog is about financial planning and stewardship, it seems like a very appropriate topic to discuss here.

Thanks for the detailed information, John.

Another threshold financial consideration for those doing Conversions, or large RMD’s, is the NIIT- the Net Investment Income Tax, which is 3.8% for 2023, which kicks in when MAGI exceeds the thresholds.

I am in the camp that considers IRMAA a TAX. The only other payments I make to any entity that decides the price to pay based on income is TAXES.

I cannot think of any other expenses where the same exact product or service for all buyers, Medicare Part B and Part D, has a different cost based on “income”.

Unfortunately, three major California utilities have proposals that would charge customers for their gas and electricity based on income. How they would get that data remains unclear, but it’s concerning.

Thanks for this, John. It’s become an annual ritual for me to sit down toward the end of the year and estimate my income for that year and compare it to the “projected” IRMAA brackets for 2 years hence. Then I can know approximately how large a Roth conversion I can make. And, like you, I always leave plenty of wiggle room in case I underestimate my income or the 2 year projected IRMAA brackets are too high.

I am 78 and retired 12 years. Unfortunately, I did not have the foresight to do Roth conversions until last 4 years when I have done large Roth conversions that triggered IRMAA tier 2 premiums. We have sizable RMDs which are offset to some extent by QCDs.

My primary motivation is to reduce our RMDs long term and do this before the expected income tax reset in 2026, when higher tax rates will likely occur.

Also, my pension and SS income make it difficult to do any other tax avoidance strategies.

The Roth funds will be part of our inheritance to our children.

My CPA gave me my MAGI # for this year and it appears I’ll be just beneath the IRMAA confiscatory cliff rates in 2 years. I’ve been doing Roth conversions for 7 years to avoid the Medicare surtax that will only get much bigger as Medicare rates rise. Most commenter agree that the major complaint is the arbitrary cliff taxation more than the extra tax itself.

I hope this warning is appreciated. I did not make Roth conversions in my 50s and 60s (I retired at 53) because my income was never low enough to put me in the lowest tax bracket. However, my RMDs now put me just over one of the cut-off points – last year my medical costs were lower because I did not have to take an RMD in 2020 (I did do a Roth conversion that year….)

As far as I am concerned this is a tax. It is income-based, and paid to the government for government services. Actually, the base premiums are also a tax – I’m always hearing that the British NHS, for instance, isn’t free, it’s paid for with taxes. Same thing here, it’s just that the tax is levied differently.

You have the option of not signing up for Medicare B and/or D, which makes it more accurate to call the charges for them income-based premiums instead of income-based taxes. My wife and I don’t pay Part D premiums because prescription drgus are covered by her retirement plan.

It doesn’t matter who pays your Part D premium- you will be billed by Medicare for IRMAA if your income exceeds the designated level.

Actually, it’s not the same thing.

Medicare Part A is paid for with a payroll tax plus the income tax revenue on taxes paid on SS at the 85% level. Part B is paid through general revenue plus premiums for those who enroll.

So as part of general revenue to the government, you can say income taxes from everyone help fund Part B while participants pay a premium as they do with Part D. Some people have their Part B premium paid by Medicaid.

For those in some MA plans that reimburse the Part B premium I don’t think we would say they reimburse taxes.

Let’s keep in mind that IRMAA doesn’t even kick in until a couple 65 and older has MAGI income greater than $194,000. That’s more than twice the median household income in America and four times more than those age 65 and older.

This is a very useful tool in managing the costs of Roth conversions. Readers should keep in mind that federally tax exempt interest is included in this definition of MAGI so these IRMAA brackets are not the same basis as federal tax brackets.

Good point. That is something I don’t think is fair. Tax-free money should all be considered the same.

But muni-bond interest IS taxable at the state level in many instances. That’s a pretty big difference compared to a Roth, don’t you think? Besides, you can take any amount of your muni-bond account basis and spend it without tax consequences, as it’s already been taxed,which is the same as a Roth account.

The issue was if it’s included in MAGI and thus used for determining IRMAA premiums.

But that’s my point, a muni-bond account’s principal withdrawals are <i>not</i> included in MAGI for determining IRMAA premiums, just like a Roth account.

If you are well-off, you will very likely pay IRMAA. I have paid every year since I turned 65, and I don’t even have any RMDs. There is nothing wrong with having a high income in retirement – why complain if you have money and don’t have to worry about paying the bills?

The article highlights how to potentially avoid the particularly steep costs toward the bottom of IRMAA brackets. I have never complained about progressive taxation for those with higher incomes. Still, I personally feel IRMAA’s structure is far from ideal with the steep cliff and two-years forward implementation.

I agree, Ormode. I received my Medicare card last week and am anxious to have the premiums and surcharges starting soon. Why? My health insurance costs will decline 55% over what I pay now for individual coverage. And that’s with IRMAA, Medigap, and Part D.

It’s the only reason to look forward to turning 65!

That depends on whether you are hit with IRMAA, and, crucially, your drug costs. Even with a good Part D plan, my drug costs last year were over $4,000, and the year before $6,000. I really need that $2,000/year max we were promised for 2025.

For those of us with high Rx costs in retirement, think lifetime tier 4 drugs, I have found that my combined premiums and out of pocket costs are lower with a preferred Part D plan. My preferred plan premium is over triple the cost of the non preferred plan premium but I have a zero deductible and my tier 4 drug is included in the plan formulary so my payments at the drugstore are much lower.

I found the plan search tool at Medicare.gov useful to me to keep the total cost of prescriptions lower. You can input your specific drugs to help make an informed decision when choosing a Part D plan.

Also, under current federal tax rules, if you have still have self employment income from a schedule C side gig your medical insurance premiums, including Part D, may be deductible above the adjusted gross income line. Like everything in taxes the answer on is it deductible for me is – it depends.

The expensive drug I took was a Tier 5, prior approval required. The prior approval meant I stayed with the same drug plan (and many formularies don’t include it). However, since I went into the “donut hole” in January and came out in February the only way to lower my costs would have been to find a plan that charged a flat $10.35 instead of 5% of retail in catastrophic coverage.

My experience with tier 5 drugs is secondary helping a friend with late stage cancer with a monthly Rx list cost of five digits. For those who are unfortunate to find themself in that situation my only practical advice is to be sure that part D premiums are being paid automatically from SSA benefits or drafted from a secure source. It was shocking to me to see her 5% share being $1K+ a month after January for thirty pills. The biologic miracle cancer drugs worked until they didn’t. I am glad that my friend had the foresight and lived her financial life in a manner that her money did not end before she did.

Those of us paying more can still complain. After all, who wants to pay more for anything, but at the same time we should recognize paying more is sometimes fair and that we are in a fortunate and enviable position to be paying more.

I wish people would stop referring to IRMAA premiums as taxes or surcharges. They are, in fact, income based premiums and I see nothing wrong with that.

More than 20% of large employers use the same strategy and more. That is, some also vary the health benefit deductible. You hit the next income bracket, you pay more in premiums and out of pocket costs. One of my sons received a raise last year and then found this year after taxes his new premiums and higher deductible nearly wiped out the raise as he had to pay the higher expenses.

I hope the retirees who plan detailed strategies to avoid or minimize IRMAA premiums are not the the same folks who criticize the super wealthy for trying to avoid taxes. Yeah, it is the same thing in my opinion.

I have a question. Aren’t Roth conversion a risk if they occur at older ages? John refers to decades of tax free earnings, but after you convert at older ages, you may not have decades of growth or the years you do have – certainly shorter than young people using a Roth – may not be the greatest for the markets. Is it possible you may not offset the income taxes paid at conversion?

The structure of IRMAA premiums is goofy at best as the article highlights. I am totally for progressive taxation for higher income taxpayers as long as it is sensibly ratable. IRMAA’s steep cliff structure two years forward potentially results in punative incremental taxation if income is not managed to get off the bracket floors.

Regarding risk: First, we undertake eightly percent of our Roth conversions in my wife’s account who has a high likelihood of outliving me. Also, our children have at least a decade to drain the Roth after we both die. Taxes must eventually be paid on IRA(s) and 401k(s). Indeed there is always rate risk arbitrage – our accounts could double or halve over time, and rates could go up or down. Tax rates are already slated to increase.

Given the timing for setting Part B premiums (Fall of the year) I don’t see how current year earnings for the following years premiums (2023 for 2024) could be used as they are not known.

As indicated in bullet four, we manage year-end Roth conversions so that income undershoots the projected forward ceiling for an IRMAA bracket which has a $60K span for married taxpayers. Inflation has moved the brackets upward a bit faster than the projections the last couple of years. Thus, we undershot by a bit more than planned. Still, this approach ensures our income is well off the bottom of an IRMAA bracket where the marginal premium cost is very high.

The two greatest expenses in retirement are medical and taxes. Since IRMAA is both, I will do what I can to maximize my economics. I would say that Roth conversion longevity risks is similar to deferring SS until 70. Though one difference would be the impact on heirs of Roth’s vs IRA.

But IRMMA is no more a tax than the standard Part B premium.

Perception is reality……it is a tax.

Part B premiums including IRMAA premiums are tax deductible as a health care expense. I’d say that means they are not a tax.

Property taxes are deductible. Does that mean they are not taxes?

Gee, property taxes are not federal taxes as many people here erroneously think Part B premiums are.